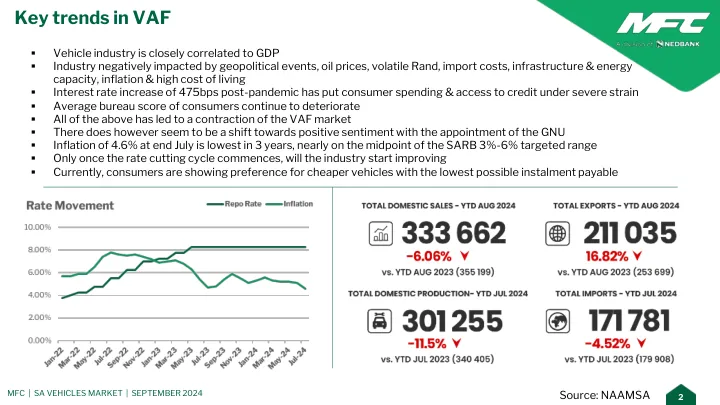

▪ Vehicle industry is closely correlated to GDP ▪ Industry negatively impacted by geopolitical events, oil prices, volatile Rand, import costs, infrastructure & energy capacity, inflation & high cost of living ▪ Interest rate increase of 475bps post-pandemic has put consumer spending & access to credit under severe strain ▪ Average bureau score of consumers continue to deteriorate ▪ All of the above has led to a contraction of the VAF market ▪ There does however seem to be a shift towards positive sentiment with the appointment of the GNU ▪ Inflation of 4.6% at end July is lowest in 3 years, nearly on the midpoint of the SARB 3%-6% targeted range ▪ Only once the rate cutting cycle commences, will the industry start improving ▪ Currently, consumers are showing preference for cheaper vehicles with the lowest possible instalment payable

SA车辆市场更新