1。Material accounting policy information ..................................................................................................................................................... 18 2.General risk management policies ............................................................................................................................................................ 20 3.Net interest and similar income .................................................................................................................................................................. 21 4.Net fee and commission income ............................................................................................................................................................... 22 5.Net gain from financial instruments at fair value .................................................................................................................................... 24 6.Other operating expense - net .................................................................................................................................................................. 24 7.Other administration expenses .................................................................................................................................................................. 24 8.Bank taxes and resolution fee .................................................................................................................................................................... 24 9.Debt securities ............................................................................................................................................................................................... 25 10.Loans to customers ...................................................................................................................................................................................... 26 11.Intangible assets .............................................................................................................................................................................................31 12.Other assets ................................................................................................................................................................................................... 32 13.Deposits from customers ............................................................................................................................................................................ 33 14.Debt securities issued .................................................................................................................................................................................. 33 15.Other liabilities ............................................................................................................................................................................................... 34 16.Contingent liabilities ..................................................................................................................................................................................... 34 17.Derivatives ...................................................................................................................................................................................................... 35 18.Fair value of financial instruments ............................................................................................................................................................. 36 19.Customer segments...................................................................................................................................................................................... 38 20.Related parties.............................................................................................................................................................................................. 40 21.Country information ..................................................................................................................................................................................... 41 Additional Information ........................................................................................................................................................................................... 42

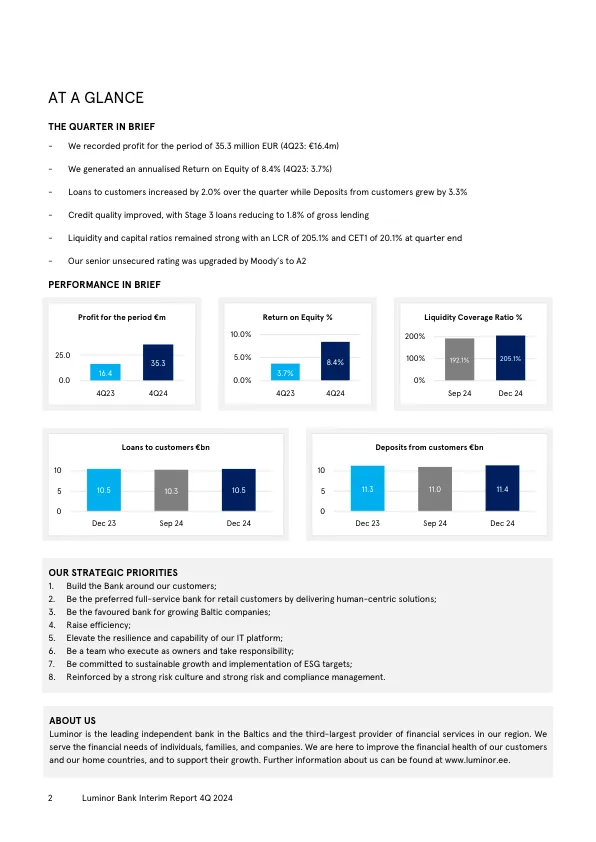

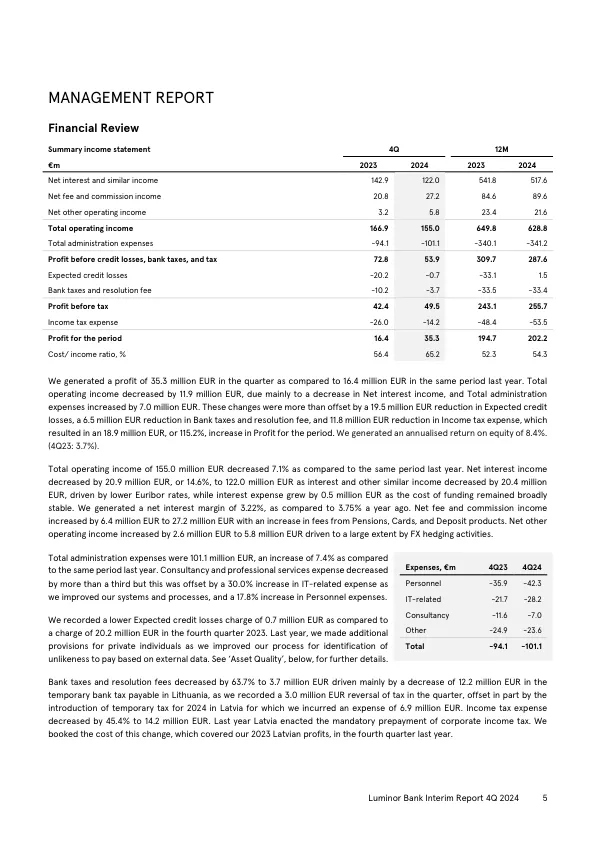

Luminor银行临时报告4Q 2024

主要关键词