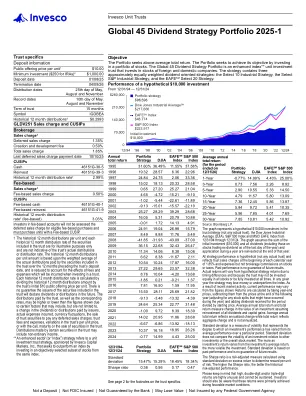

† The historical 12 month distributions per unit and each historical 12 month distribution rate of the securities included in the trust are for illustrative purposes only and are not indicative of the trust's actual distributions or distribution rate. The historical 12 month distributions per unit amount is based upon the weighted average of the actual distributions paid by the securities included in the trust over the 12 months preceding the trust's deposit date, and is reduced to account for the effects of fees and expenses which will be incurred when investing in a trust. Each historical 12 month distribution rate is calculated by dividing the historical 12 month distributions amount by the trust's initial $10 public offering price per unit. There is no guarantee the issuers of the securities included in the trust will declare dividends or distributions in the future. The distributions paid by the trust, as well as the corresponding rates, may be higher or lower than the figures shown due to certain factors that may include, but are not limited to, a change in the dividends or distributions paid by issuers, actual expenses incurred, currency fluctuations, the sale of trust securities to pay any deferred sales charges, trust fees and expenses, variations in the trust's per unit price, or with the call, maturity or the sale of securities in the trust. Distributions made by certain securities in the trust may include non-ordinary income. ** An enhanced sector (or “index”) strategy refers to a unit investment trust strategy, sponsored by Invesco Capital Markets, Inc., that seeks to outperform an index by investing in an objectively selected subset of stocks from the same index.

Global 45 Dividend Strategy Portfolio 2025-1