XiaoMi-AI文件搜索系统

World File Search SystemEconomic Development Programs Year 12

To receive the tax exemption, qualifying businesses must apply to the Department of Commerce (FloridaCommerce). 8 The Division of Economic Development within FloridaCommerce then reviews applications and recommends approval or disapproval. Upon department approval, certifications for the exemption are valid for two years but can be renewed for another two years. Once the exemption certifications are granted, the Department of Revenue is responsible for issuing the tax exemption certificate to each qualifying business. Per s. 212.08(5)(j)5.d., Florida Statutes , applications and renewals for the SDST exemption are required to indicate the value of the investments made in real and tangible personal property, and the value of tax-exempt purchases and taxes exempted during the previous calendar year. 9, 10

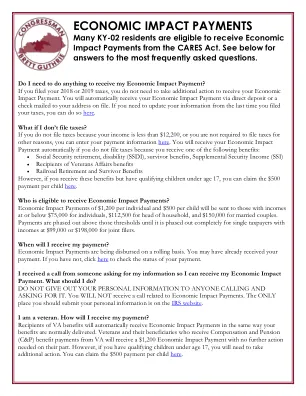

经济影响支付

经济影响补助金 许多 KY-02 居民都有资格从《关怀法案》中获得经济影响补助金。请参阅下文对最常见问题的解答。 我需要做什么才能收到经济影响补助金吗? 如果您已经申报了 2018 年或 2019 年的税款,则无需采取其他行动即可收到经济影响补助金。您将自动通过直接存款或支票邮寄到您登记的地址收到经济影响补助金。如果您需要更新上次申报税款时的信息,可以在此处进行更新。 如果我不报税会怎样? 如果您因为收入低于 12,200 美元而未报税,或者由于其他原因您无需报税,您可以在此处输入您的付款信息。 如果您因获得以下福利之一而未报税,您将自动收到经济影响补助金:

税收增量融资计划指南

这些项目的资金来自 23 年期间区内不断增加的房地产税。当 TIF 区成立时,区内房地产的总均衡评估价值 (EAV) 确定了 TIF 的基准值。随着该地区的发展,新的房地产税将从 TIF 区基准以上的 EAV 增长中产生。这些资金被称为增量房地产税 - 通常称为“IPT”或简称为“增量” - 可用于符合条件的再开发成本。同时,在 TIF 的整个有效期内,对基准价值征收的税款将继续分散给其他征税机构。当 TIF 区到期时,超过基准的 EAV 增加部分将正常征税,资金将根据其征收额分配给每个征税机构。下表解释了这一过程。

UK TAX STRATEGY – Peugeot Motor Company PLC

UK TAX STRATEGY – Peugeot Motor Company PLC Peugeot Motor Company plc and related companies 1 , referred to as Peugeot Group, operate in the automotive industry. The business activities of the Peugeot Group generate a substantial amount and variety of taxes. In the UK, we pay Corporation Tax, Customs Duty, Stamp Duty Land Tax, employer and other taxes. In addition, we collect and pay employee taxes and VAT. The taxes we pay and collect form a significant part of our economic contribution to the UK economy. Peugeot Group's tax strategy reflects the business practices and ethos, as demonstrated in the arrangements described below. Approach to risk management and governance arrangements The team of tax specialists acting on behalf of Peugeot Group have many years' experience in UK and international direct and indirect taxation. The UK Head of Tax reports quarterly to the Board of Directors in respect of all tax matters for legal entities forming part of this Tax Strategy. Our internal processes and controls support the tax compliance and transactional tax obligations of the business providing our Board and Senior Accounting Officer with a robust framework for calculation and payment of taxes due. Where any process weakness is identified, new processes and controls are implemented as necessary. The Board and Senior Accounting Officer are involved in review processes and are also engaged in approving transactional details including any tax related aspects. The tax team therefore remain accountable to the wider business, frequently exchanging updates relating to business and tax developments. Management of tax risks is a constant process. We identify, assess and manage tax risks and account for them appropriately. We aim to reduce the level of tax risk as far as is reasonably practicable by ensuring that robust and appropriate processes are in place for all activities which could have a material impact on our tax affairs. Peugeot Group is committed to complying with all applicable laws, regulations and disclosure requirements in accordance with the Stellantis Tax Policy. We observe both the spirit as well as the letter of the law and pay an appropriate amount of tax for our business at the right time. Attitude to Tax planning Peugeot Group engages in tax planning that follows the spirit of UK Tax Law and has commercial substance that supports the business and reflects genuine commercial and economic activity, ensuring the appropriate amount of tax is levied and that enables it to manage its tax efficiently. We do not use contrived or abnormal tax structures that are intended for tax avoidance. We adhere to relevant tax law and seek to minimize the risk of dispute arising from uncertain positions. External advice is sought when in-house Tax staff need assistance with interpretation of complex tax law. The Peugeot Group reports transactions with other group companies on an arm's length basis and in accordance with current OECD principles.

等级组税策略2025

1。防止赌博成为犯罪和混乱的根源,2。确保以公平开放的方式进行赌博,3。保护儿童和弱势群体免受赌博的伤害或利用。等级致力于安全,公平的游戏,并认识到持续创新以使赌博尽可能安全的重要性。英国税收贡献等级总部位于英国,并为英国财政部做出了大力贡献,截至2024年6月30日,这一年的直接和间接税款约为1.6亿英镑。排名的主要付款是:投注和游戏收入等级的最大贡献来自博彩和游戏职责。这些是由我们的场地和数字业务产生的博彩和游戏收入收取的。在远程游戏中,通常在客户所在的国家而不是业务运营所在的国家 /地区的国家 /地区支付职责。不可恢复的增值税等级会在其购买的商品和服务上产生增值税。投注和游戏在英国免于增值税,这意味着排名无法收回其造成的大量增值税,从而使其成为企业的成本。公司税收排在英国根据英国税法计算的应税利润支付公司税。雇主税款相关的税款,例如国家保险和社会保障,由英国的主要雇主等级支付。其他向政府支付的税款和付款等级还有许多其他税款,包括财产税,例如业务税,环境税,例如气候变化征税和许可费。

渐进所得税的替代基本原理

Harashima Taiji * 2020年4月,基于付款能力(ATP)和平等的牺牲原则,抽象的渐进所得税通常是合理的,但是应如何衡量ATP和牺牲仍然没有解决。在本文中,我根据可持续异质性(SH)的概念提出了渐进税的替代基本原理。我得出的结论是,必须逐步实现所得税,因此,在不依靠ATP和平等牺牲原则的情况下,渐进的所得税是合理的。此外,为了实现SH,家庭还应该承担税收负担,以支付以其收入成比例地实现SH以外的其他政策目标的费用,也就是说,与其消费相关,例如与增值税相关的案件。JEL分类代码:D63,H21,H24关键字:付费原理;收益原则;平等牺牲原则;累进税;社会福利;可持续异质性 *信函:卡纳泽·塞里约大学(Kanazawa Seiryo University),伊西卡瓦(Ishikawa),卡纳泽(Kanazawa),吉罗岛(Goshoccoly-ushi),哈沙泽·塞里约大学(Kanazawa Seiryo University),日本920-8620。电子邮件:harashim@seiryo-u.ac.jp或t-harashima@mve.biglobe.ne.jp。

税务策略 截至 2024 年 3 月 31 日

本策略自发布之日起适用,直至被取代。对“英国税收”的提及是指附表第 15(1) 段所列的税项和关税,包括所得税、公司税、预扣所得税、国民保险税、增值税、保险费税和印花税土地税。对“税收”、“税项”或“税收”的提及是指英国税收以及集团负有法律责任的所有相应的全球税收和类似关税。

机密,不得广泛传播 仅供参考 主题 经济原则和税收制度基本原理概述

1 《了解爱尔兰的收入不平等》 Roantree (2020) 2 普华永道 2020 年纳税报告显示爱尔兰在欧盟保持领先地位 3 2020 年纳税报告 - 总体排名和数据表

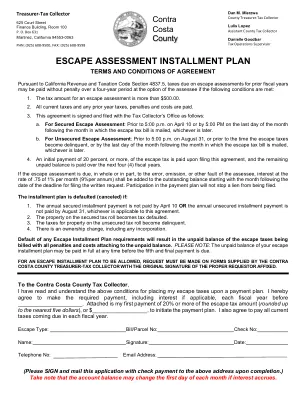

逃生评估分期付款计划

(a) 不论法律是否有其他规定,纳税人可选择在四年内缴纳前几年逃税评估的应纳税款,无论是有担保的还是无担保的,前提是:(1) 附加税超过五百美元 (500 美元),并且 (2) 纳税人在担保税单上的第二期税款逾期之前或在税单邮寄后的下个月最后一天之前(以较晚时间为准)向税务人员提交了分期付款的书面申请。税务人员应在财产税单中附上本条付款规定的通知。对于无担保税款,应在税款逾期之日之前向税务人员提交分期付款的书面申请。