机构名称:

¥ 1.0

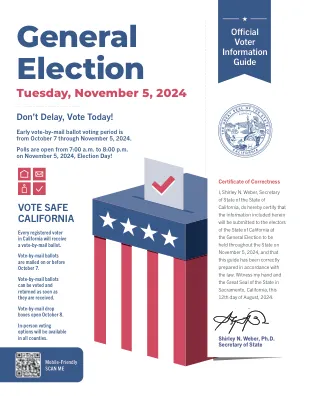

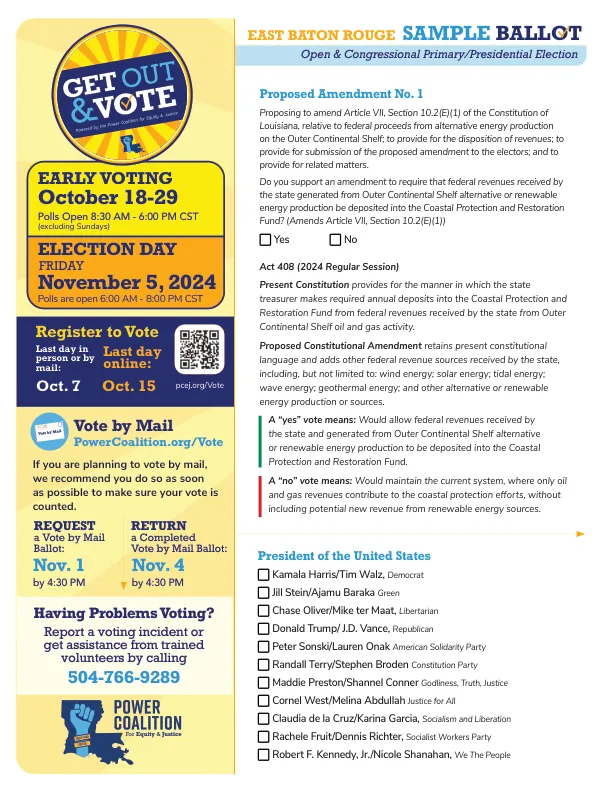

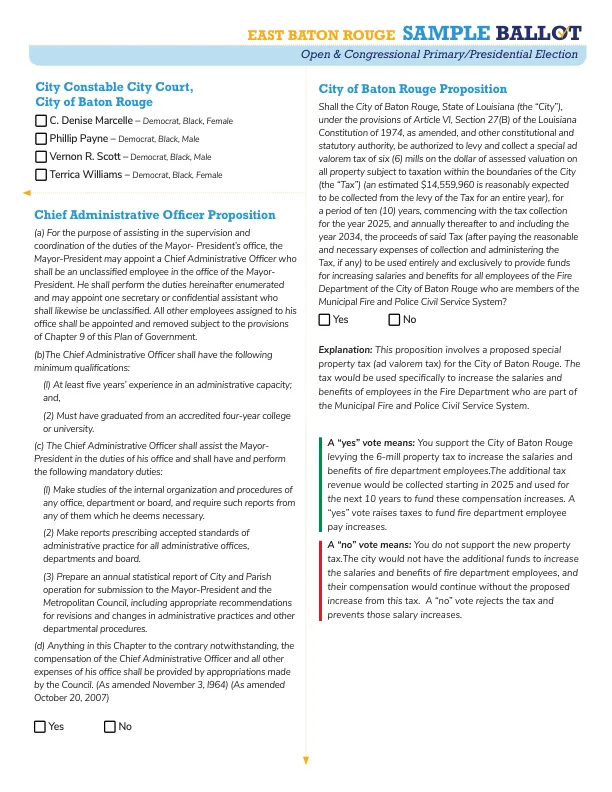

Shall the City of Baton Rouge, State of Louisiana (the “City”), under the provisions of Article VI, Section 27(B) of the Louisiana Constitution of 1974, as amended, and other constitutional and statutory authority, be authorized to levy and collect a special ad valorem tax of six (6) mills on the dollar of assessed valuation on all property subject to taxation within the boundaries of the City (the “税”)(估计将从全年的税收征税中收取约14,559,960美元),为期十(10)年,从2025年开始收取税款,然后每年每年及其在2034年内及时征收该税收的税收(如果征收任何税收),则需要支付任何税收,并付费,并征收任何税收的收益,并征收税收的收益,并征收税款,并征收税款,并以征收税收,并付费。资金增加了巴吞鲁日消防局所有雇员的薪水和福利,他们是市政消防和警察公务员制度系统的成员?

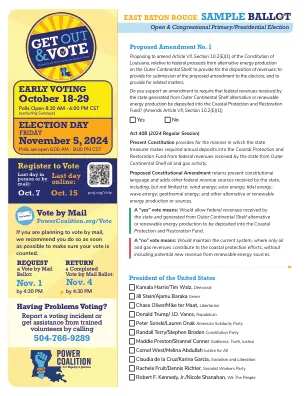

2024年11月5日至10月18日至29日

![arxiv:2401.14907v2 [cs.ro] 2024年11月29日](/simg/0/0d8974404b80c2e87a42eedcdacbe5baabb4b814.webp)