机构名称:

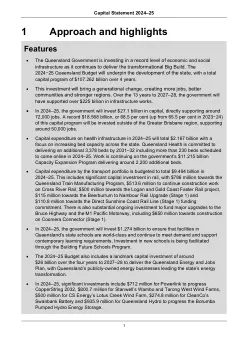

¥ 21.0

正税支出和扣除超级C2超级C2雇主退休金的优惠税y 29,150 14.2 4.1 CGT E8主要居留豁免豁免 - 折扣组件27,000 18.6 8.0扣除扣除扣除扣除Y 26,500 26,500 14.4 6.1 CGT E7 MAIN EXPERTIND 22折扣22.5折扣22.5 Y.7 C Y Y 22 Y.7 C Y.7 C Y 7.7 CGT EN 7.7 CGT 27.0 -3.4 Super C4 Concessional taxation of superannuation earnings Y 22,200 6.2 13.0 Income A26 Exemption for National Disability Insurance Scheme amounts 11,420 29.7 8.8 Deductions Work-related expenses Y 11,300 10.6 3.7 GST H25 Food 9,500 6.1 3.6 GST H17 Health – medical and health services 5,400 5.0 6.5 GST H14 Education 4,550 6.6 5.4收入A27豁免育儿援助付款4,100 20.8 4.9收入B63小型公司的税率降低y 3,500 11.1 2.6 GST H2金融供应 - 投入纳税待遇3,500 3.7 4.5 4.5 FBT D15公共福利机构免税某些ESCERITION 2,930 11.5 0.3

2024-25税收支出和见解声明