机构名称:

¥ 1.0

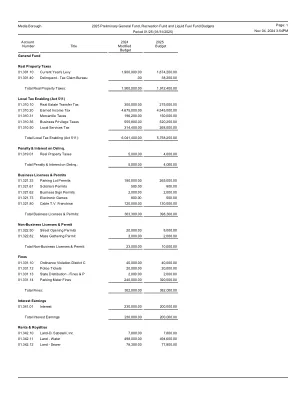

省级税收来源个人所得税4,174,435 4,525,250 4,730,924企业所得税748,944 831,397 8397 836,540统一的销售税2,7555,642 2,689,6662 2,588,2333333333333333334 vap an 3,353 3,085 3,085 Non-resident Deed Transfer Tax 11,473 14,521 27,752 Motive Fuel Tax 278,243 279,133 284,393 Tobacco Tax 114,084 107,795 93,291 Other Tax Revenue 241,718 245,231 248,607 Prior Years' Adjustments - Provincial Taxes --- 527,148 ---机动车注册表147,916 152,825 155,425其他省级来源174,087 174,087 170,045 176,530 TCA共享收入13,751 9,823 9,823 10,278其他费用和费用67,103 6363,879 62,879 62,879 62,87,897 and) 1,700利息收入140,410 189,666 188,226沉没基金收入22,414 22,893 27,143普通回收率415,410 576,949 424,824政府企业企业的净收入净收入10,921,583 10,344,403

潜在预算2025-26