XiaoMi-AI文件搜索系统

World File Search System新闻摘要中的持续学习-Jiliang(Eric)li

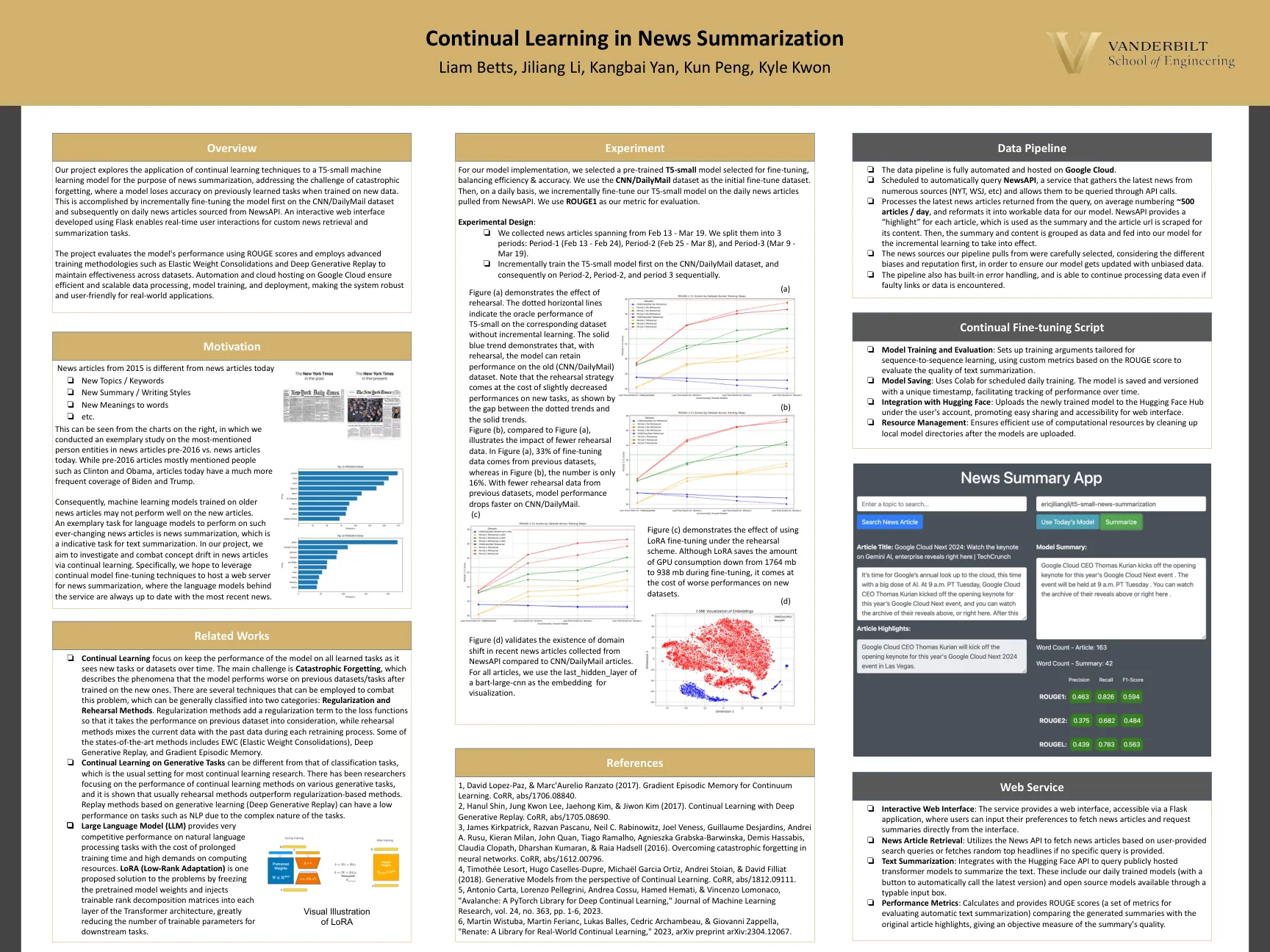

Web服务1,David Lopez-Paz和Marc'aurelio Ranzato(2017)。连续学习的梯度情节记忆。corr,ABS/1706.08840。2,Hanul Shin,Jung Kwon Lee,Jaehong Kim和Jiwon Kim(2017)。 持续学习,并具有深刻的生成重播。 corr,ABS/1705.08690。 3,詹姆斯·柯克帕特里克(James Kirkpatrick),拉兹万·帕斯卡努(Razvan Pascanu),尼尔·C·拉比诺维茨(Neil C. Hadsell(2016)。 克服神经网络中的灾难性遗忘。 Corr,ABS/1612.00796。 4,TimothéeLesort,Hugo Caselles-Dupre,MichaëlGarciaOrtiz,Andrei Stoian和David Filliat(2018)。 从持续学习的角度来看生成模型。 corr,ABS/1812.09111。 5,Antonio Carta,Lorenzo Pellegrini,Andrea Cossu,Hamed Hemati和Vincenzo Lomonaco,“ Avalanche:Pytorch的深度持续学习图书馆”,《机器学习研究杂志》,第1卷。 24,否。 363,pp。 1-6,2023。 6,Martin Wistuba,Martin Ferianc,Lukas Balles,Cedric Archambeau和Giovanni Zappella,“ Renate:现实世界中持续学习的图书馆”,2023年,Arxiv Preprint Arxiv:2304.12067。2,Hanul Shin,Jung Kwon Lee,Jaehong Kim和Jiwon Kim(2017)。持续学习,并具有深刻的生成重播。corr,ABS/1705.08690。3,詹姆斯·柯克帕特里克(James Kirkpatrick),拉兹万·帕斯卡努(Razvan Pascanu),尼尔·C·拉比诺维茨(Neil C. Hadsell(2016)。克服神经网络中的灾难性遗忘。Corr,ABS/1612.00796。4,TimothéeLesort,Hugo Caselles-Dupre,MichaëlGarciaOrtiz,Andrei Stoian和David Filliat(2018)。 从持续学习的角度来看生成模型。 corr,ABS/1812.09111。 5,Antonio Carta,Lorenzo Pellegrini,Andrea Cossu,Hamed Hemati和Vincenzo Lomonaco,“ Avalanche:Pytorch的深度持续学习图书馆”,《机器学习研究杂志》,第1卷。 24,否。 363,pp。 1-6,2023。 6,Martin Wistuba,Martin Ferianc,Lukas Balles,Cedric Archambeau和Giovanni Zappella,“ Renate:现实世界中持续学习的图书馆”,2023年,Arxiv Preprint Arxiv:2304.12067。4,TimothéeLesort,Hugo Caselles-Dupre,MichaëlGarciaOrtiz,Andrei Stoian和David Filliat(2018)。从持续学习的角度来看生成模型。corr,ABS/1812.09111。5,Antonio Carta,Lorenzo Pellegrini,Andrea Cossu,Hamed Hemati和Vincenzo Lomonaco,“ Avalanche:Pytorch的深度持续学习图书馆”,《机器学习研究杂志》,第1卷。24,否。363,pp。1-6,2023。6,Martin Wistuba,Martin Ferianc,Lukas Balles,Cedric Archambeau和Giovanni Zappella,“ Renate:现实世界中持续学习的图书馆”,2023年,Arxiv Preprint Arxiv:2304.12067。6,Martin Wistuba,Martin Ferianc,Lukas Balles,Cedric Archambeau和Giovanni Zappella,“ Renate:现实世界中持续学习的图书馆”,2023年,Arxiv Preprint Arxiv:2304.12067。

摘要。这项工作旨在回顾人工神经网络(ANN)的最典型实现,这些实现是在前馈神经网络中实现的。

摘要。这项工作旨在回顾人工神经网络 (ANN) 的最典型实现,这些实现在前馈神经网络 (FNN) 和循环神经网络 (RNN) 中实现。讨论了 ANN 架构和基本操作原理的本质区别。学习过程的问题分几个部分介绍。使用 ANN 进行预测的优势已在自适应教育学、医学和生物学分类、工业等多个热门领域得到证实。JEL:C45。关键词:人工智能;人工神经网络;前馈神经网络;循环神经网络;感知器。引用:Alytis Gruodis (2023) 人工神经网络在过程建模中的实现。当前实现概述。– 应用业务:问题与解决方案 2(2023)22–27 – ISSN 2783-6967。https://doi.org/10.57005/ab.2023.2.3

产品特征摘要

疫苗刺激对马流感的主动免疫。疫苗菌株VCP2242和VCP3011是重组的金黄色葡萄球菌病毒,表达了来自马型流感流感病毒菌株A/eq/eq/ohio/03(佛罗里达州sublineeage 1)和a/eq/eq/eq/eq/eq/richond clade clade clade clade clade clase america clase america clase american clase clase american amerine clade clase american amerine clase feartime a eq/eq/ehio/03(美国)接种后,病毒不会在马中繁殖,而是表达保护蛋白。因此,这些成分诱导了针对马流感病毒的免疫力(H 3 N 8)。

2024 年 2 月月度摘要.pdf

每年 2 月 28 日都会庆祝国家科学日,以纪念“拉曼效应”的发现。2024 年国家科学日 (NSD) 的主题是“Viksit Bharat 的本土技术”,由印度科技部部长 Jitendra Singh 博士于 2024 年 2 月 6 日在新德里国家媒体中心发布。22 个邦科技委员会参加了 NSD 庆祝活动,通过 DST 资助的多项活动,活动覆盖了 13,29,275 名学生、教师和普通公众。 2024 年 NSD 的主要活动由 DST 于 2 月 28 日在新德里 Vigyan Bhawan 组织。当天的主宾是印度科技部部长 Jitendra Singh 博士。出席此次活动的有科学秘书、贵宾、科学家、技术专家、政策制定者、学校和学院的学生、研究学者以及来自不同州的利益相关者,他们以混合模式参加活动。今年的活动超越了国界,印度驻日本大使馆的官员以及在日本的印度学生和研究人员也出席了活动。 尊敬的科技部长推出了一部电影“Vigyan ki Aawaz”,重点介绍了印度科技部 (DST) 在过去十年中取得的卓越成就,这是一个播客系列,展示了印度科学家及其来自 DST 各个自治研究所的突破性成就。他还公布了科学研究与创新倡议 (IRIS) 的项目汇编,提供了年度 IRIS 计划、最近结束的 IRIS 全国博览会的见解以及入选前 20 个项目的摘要。尊敬的部长还祝贺三个 SATHI 中心,即孟买化学技术学院 (ICT)、海得拉巴印度理工学院 (IIT);以及皮拉尼 Birla 理工学院。活动期间还发布了一份题为“演进:催化印度电动汽车技术主导的生态系统”的白皮书,该白皮书阐明了技术在促进印度可持续电动汽车生态系统方面的发展。 印度理工学院马德拉斯分校的 Bhaskar Ramamurthi 教授发表了关于使印度在 2047 年成为发达国家的电信技术的演讲,班加罗尔拉曼研究所的 Urvashi Sinha 教授介绍了她对 Viksit Bharat@2047 量子技术的看法。此外,还组织了两场小组讨论,主题是“弥合知识鸿沟:到 2047 年实现 Viksit Bharat 的有效科学传播”和“到 2047 年加强研究和开发 Viksit Bharat 的本土技术”,邀请了杰出的科学传播者。

1月2日22013 510(k)摘要-AccessData.fda.gov

(合规对)。从涉嫌血流细菌/酵母菌感染的728名成年患者中获得了总共1656瓶对。当套装中的任何一个瓶子被BACT/警报系统确定为正时,都进行了两个瓶子的亚文化。如果FA Plus或Fa瓶的亚文化为正,则确定一对瓶子具有正状态。一个文化瓶被确定为一个。“ true阳性”如果培养物被BACT/警报系统标记为阳性,并导致该瓶子亚文化的分离物生长。计算了FA Plus和FA培养瓶的真正正率,并计算了FA Plus真正的阳性与PA真实阳性的比例以比较性能。根据临床试验地点的确定,回收的临床分离株被归类为显着,污染物或未知。从所有合规性的有氧培养对中回收了总共267个分离株。总共有238瓶对,通过FA Plus或FA瓶的亚文化恢复了至少1个分离株。214瓶对的TDTAL回收了一个单独的分离株,19瓶对回收了两个分离株,5瓶对回收了3个分离株。下表中报告的总人口包括从正瓶对和1418个负瓶对中回收的267个分离株,总共1685个结果。

您的战略需要一份战略执行摘要(新)

○ 诊断师 - 以客观和外部的视角诊断业务环境,并将组织的战略与已确定的环境相匹配 ○ 细分者 - 构建组织,使其战略与相应的业务环境相匹配 ○ 颠覆者 - 不断审查和审视诊断和细分,并质疑它们是否与业务环境相一致,以防止僵化 ○ 团队教练 - 选择合适的人来管理他们的战略部分,并加深他们对战略调色板的理解 ○ 销售人员 - 倡导并向投资者和员工传达所选战略 ○ 询问者 - 提出探索性问题以改进战略方针 ○ 天线 - 向外看,捕捉不断变化的外部环境的信号 ○ 加速器 - 重视需要额外自上而下支持的关键举措

一页摘要防止租赁住房卡车的算法促进

●使租赁财产所有者为协调租赁住房价格和供应信息的公司的服务合同,并指定此类安排本身违反《谢尔曼法》; ●禁止在两个或多个租赁财产所有者中协调价格,供应和其他租赁住房信息的实践; ●使两个或多个协调员合并在合并产生明显减少竞争的风险的情况下合并; ●允许单个原告无效任何证据前的仲裁协议或截止前的联合行动豁免,这将阻止其根据本法提起诉讼。

2022 年 7 月 22 日校长会议摘要概述

概述 2022 年 7 月 22 日,北极执行指导委员会 (AESC) 在拜登-哈里斯政府内举行了第三次负责人会议。履行白宫科技政策办公室主任职责的总统副助理 Alondra Nelson 博士主持了会议。Katie Tobin 代表担任 AESC 副主席的总统国家安全顾问 Jake Sullivan。会议包括以下部分: