The European Union has set itself the goal of channelling financial flows into sustainable investments, for example with the Disclosure Regulation and the taxonomy. Asset managers will therefore also have to make their financial products more sustainable. Unlike investors in the equity and bond markets, who can focus on more sustainable companies and countries, Union Investment Real Estate, as the shareholders of the properties themselves, is responsible for implementing the legal climate protection requirements. In order to meet the requirements and avoid write-down risks due to stranded assets, we are continuously optimising our real estate portfolio. In doing so, we not only take into account transitory climate risks, but also the physical effects of climate change, such as storms and flood disasters.

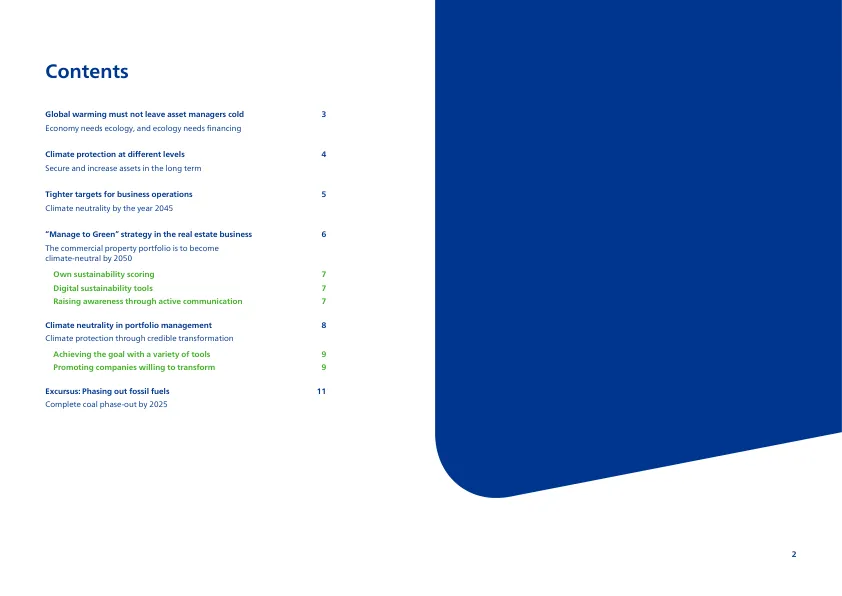

Union Investment's climate strategy

主要关键词