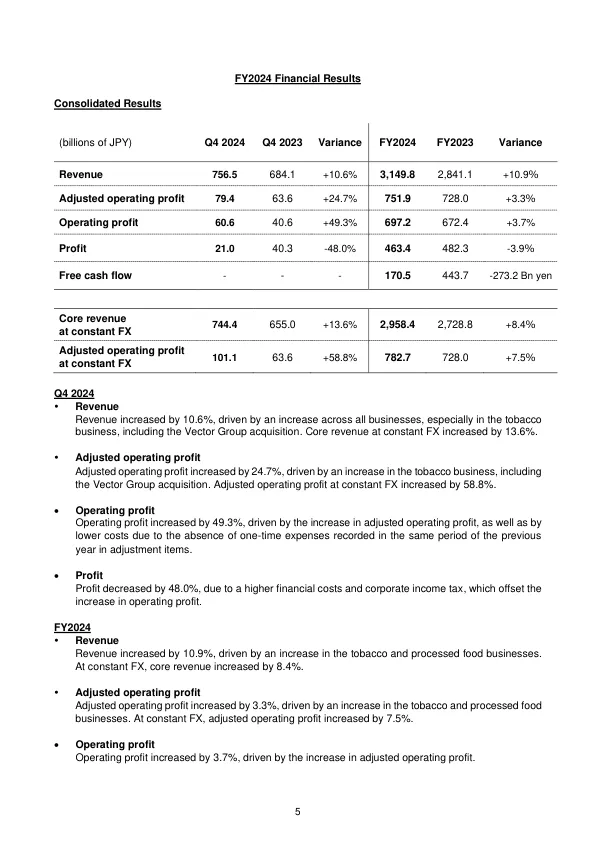

Tokyo, February 13, 2025 2024 Earnings Report FY2024 Highlights (vs. FY2023) Revenue increased by 10.9% to JPY 3,149.8 billion Core revenue at constant FX increased by 8.4% to JPY 2,958.4 billion Adjusted operating profit at constant FX increased by 7.5% to JPY 782.7 billion On a reported basis, adjusted operating profit increased by 3.3% to JPY 751.9 billion Operating profit increased by 3.7% to JPY 697.2 billion Profit decreased by 3.9% to JPY 463.4 billion Free cash flow decreased by JPY 273.2 billion to JPY 170.5 billion The Company plans to pay an annual dividend per share of JPY 194 (a dividend payout ratio of 74.3%) FY2025 Forecasts (vs. FY2024) Revenue is forecast to increase by 3.9% to JPY 3,273.0 billion Core revenue at constant FX is forecast to increase by 6.6% to JPY 3,232.0 billion Adjusted operating profit at constant FX is forecast to increase by 8.4% to JPY 815.0 billion On a reported basis, adjusted operating profit is forecast to decrease by 2.2% to JPY 735.0 billion Operating profit is forecast to decrease by 3.8% to JPY 671.0 billion Profit is forecast to decrease by 2.9% to JPY 450.0 billion Free cash flow is forecast to increase by JPY 177.5 billion to JPY 348.0 billion The Company plans to offer an annual dividend per share of JPY 194 (a dividend payout ratio以76.5%的速度)请参阅第16页的“数据表”,以获取更多财务数据。JT集团总裁兼首席执行官Masamichi Terabatake的评论:“我很高兴地报告,尽管我们在运营环境中面临着挑战,但2024 JT集团的绩效在收入和调整后的运营利润方面达到了创纪录的收入和调整后的利润。我们的主要指标Constant FX处的调整后的营业利润增加了7.5%。在烟草业务中,JT集团的利润增长引擎,绩效是由可燃物中的稳固价格驱动的。此外,我们正在朝着2028年对RRP业务的野心稳步发展。我们的优先投资HTS的地理扩展在2024年底达到了24个市场。我们在每个市场中都有HTS细分市场的份额,在日本,最大的HTS市场,我们的份额在上一季度达到了12.6%。成功地收购了Vector Group Ltd。考虑到我们的股东退货政策,我们计划为2024财年支付每股194日元的年度股息。在2025年的业务计划中,覆盖2025年至2027年,我们的目标是通过通过定价和市场份额增长来增强收入,同时增强盈利能力,以继续提高可燃收入的投资回报率(ROI)。在RRP中,尽管对HTS类别的投资加强了投资,但我们希望在当前业务计划期间对收益有利。在接下来的三年期间,我们预计在恒定FX时调整后的营业利润将在高单位数字中的平均复合年增长率上升。我们打算在长期到长期内为我们的4S模型*利益相关者提供增量价值。我们计划按照我们的股东退货政策稳步增长股息,该政策的目标是75%。

2024收益报告

主要关键词