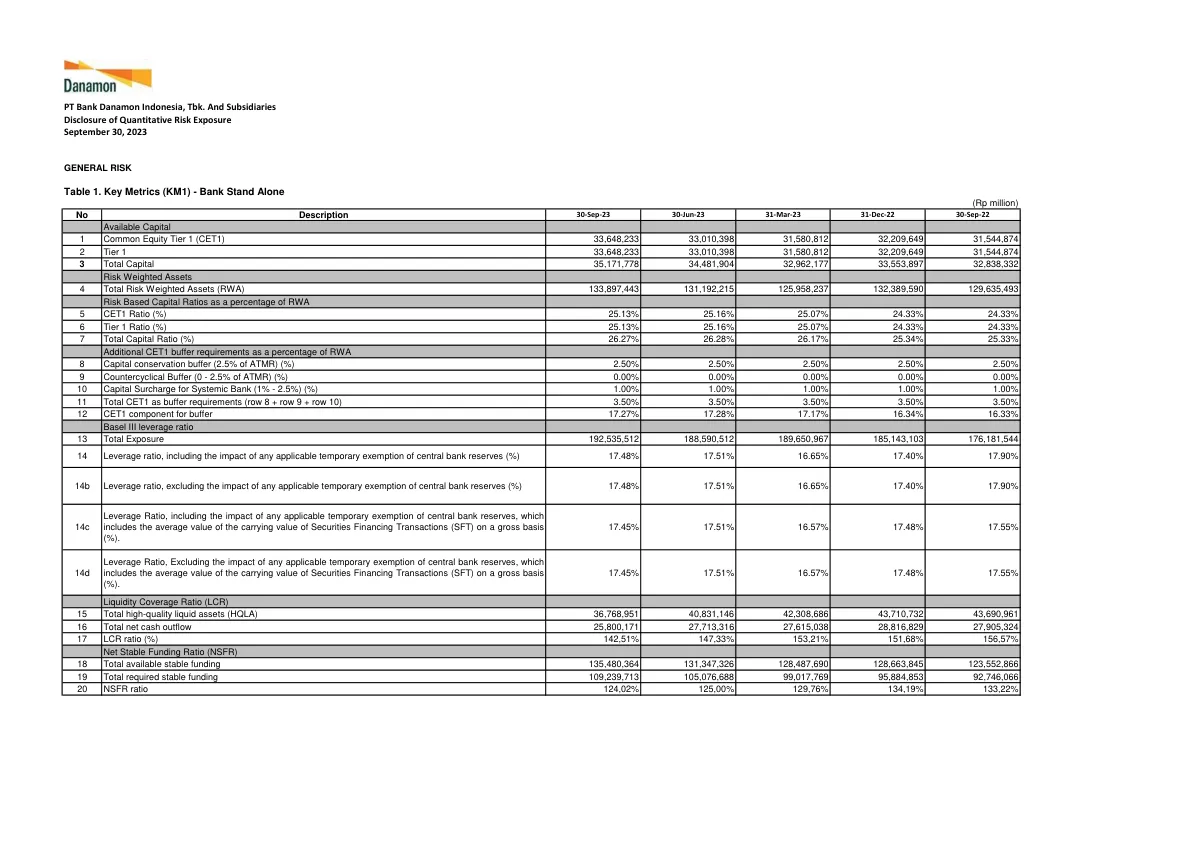

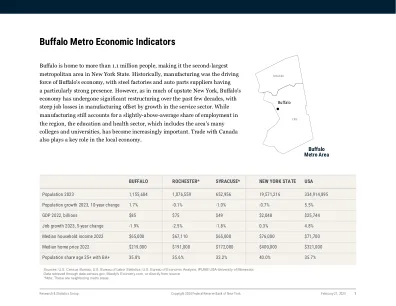

(Rp million) No Description 30-Sep-23 30-Jun-23 31-Mar-23 31-Dec-22 30-Sep-22 Available Capital 1 Common Equity Tier 1 (CET1) 33,648,233 33,010,398 31,580,812 32,209,649 31,544,874 2 Tier 1 33,648,233 33,010,398 31,580,812 32,209,649 31,544,874 3总资本35,171,778 34,481,904 32,962,177 33,553,897 32,838,897 32,838,83333332的风险重量调味量(32,3333)393 33 33 3333 33 33 33.43,33,33,33,33,33,33,33,33,l an。 131,192,215 125,958,237 132,389,590 129,635,493 Risk Based Capital Ratios as a percentage of RWA 5 CET1 Ratio (%) 25.13% 25.16% 25.07% 24.33% 24.33% 6 Tier 1 Ratio (%) 25.13% 25.16% 25.07% 24.33% 24.33% 7 Total Capital Ratio (%) 26.27% 26.28% 26.17% 25.34% 25.33% Additional CET1 buffer requirements as a percentage of RWA 8 Capital conservation buffer (2.5% of ATMR) (%) 2.50% 2.50% 2.50% 2.50% 2.50% 9 Countercyclical Buffer (0 - 2.5% of ATMR) (%) 0.00% 0.00% 0.00% 0.00% 0.00% 10 Capital Surcharge for Systemic Bank (1% - 2.5%) (%) 1.00% 1.00% 1.00% 1.00% 1.00% 11 Total CET1 as buffer requirements (row 8 + row 9 + row 10) 3.50% 3.50% 3.50% 3.50% 3.50% 12 CET1 component for buffer 17.27% 17.28% 17.17% 16.34% 16.33% Basel III leverage ratio 13 Total Exposure 192,535,512 188,590,512 189,650,967 185,143,103 176,181,544

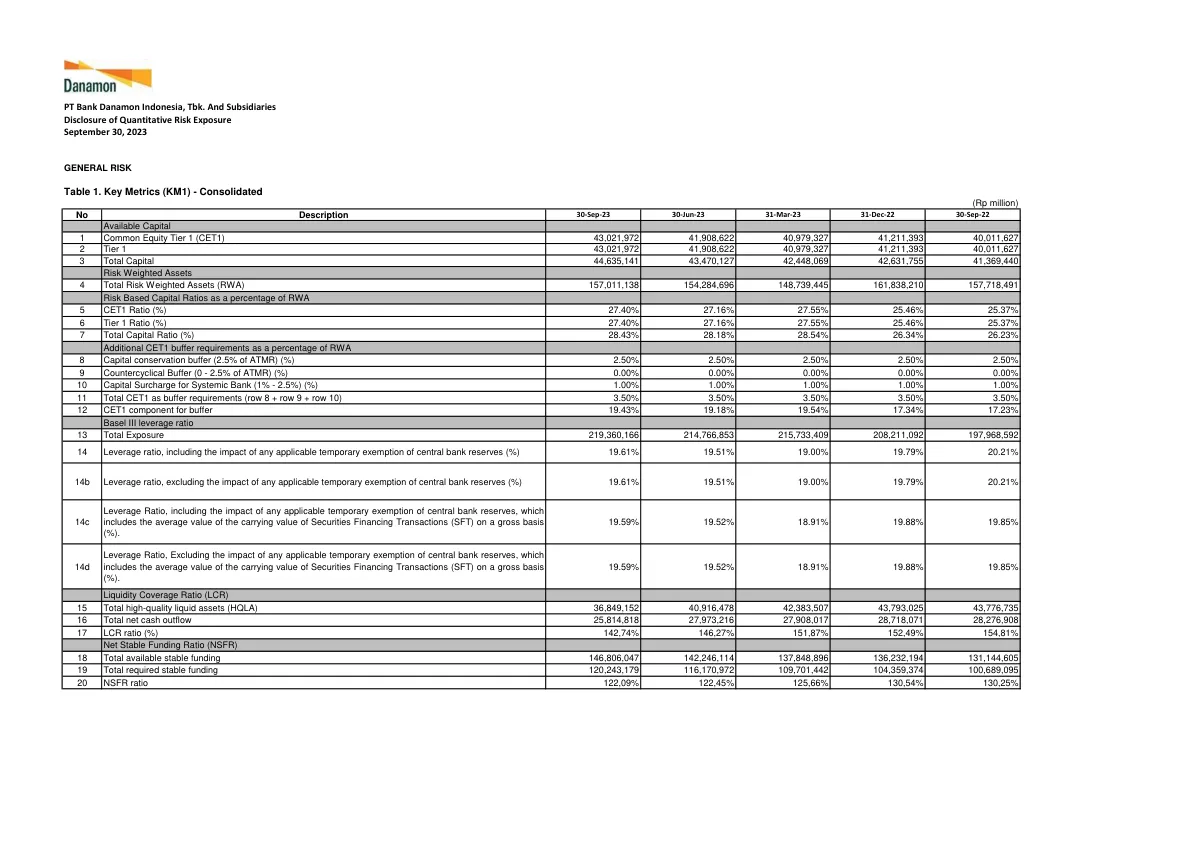

表1。键指标(KM1)