机构名称:

¥ 1.0

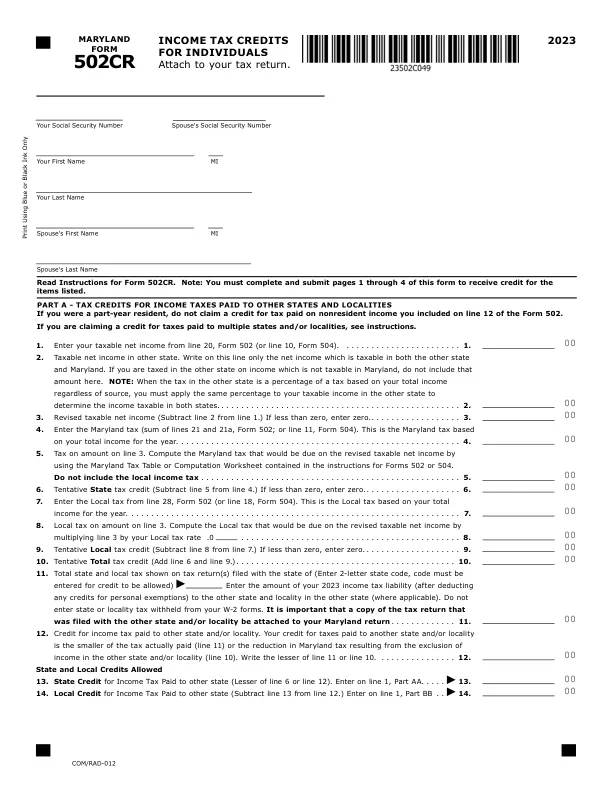

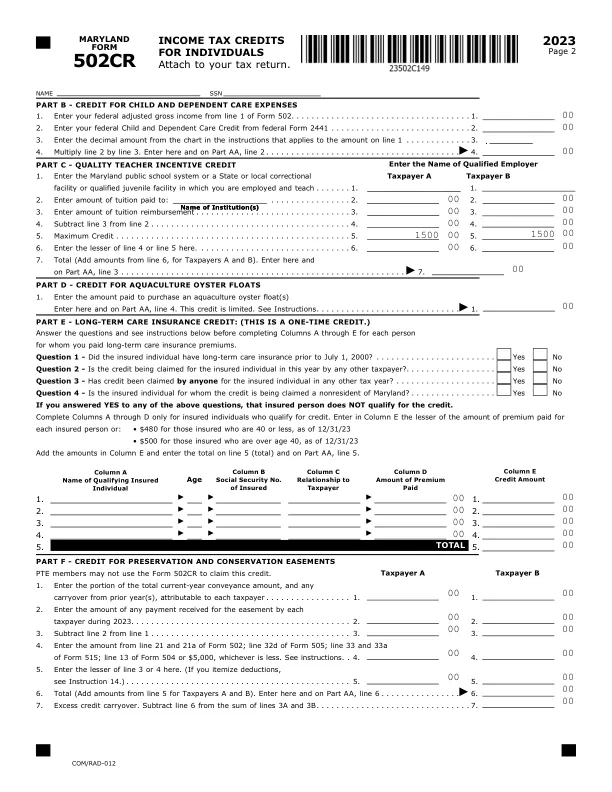

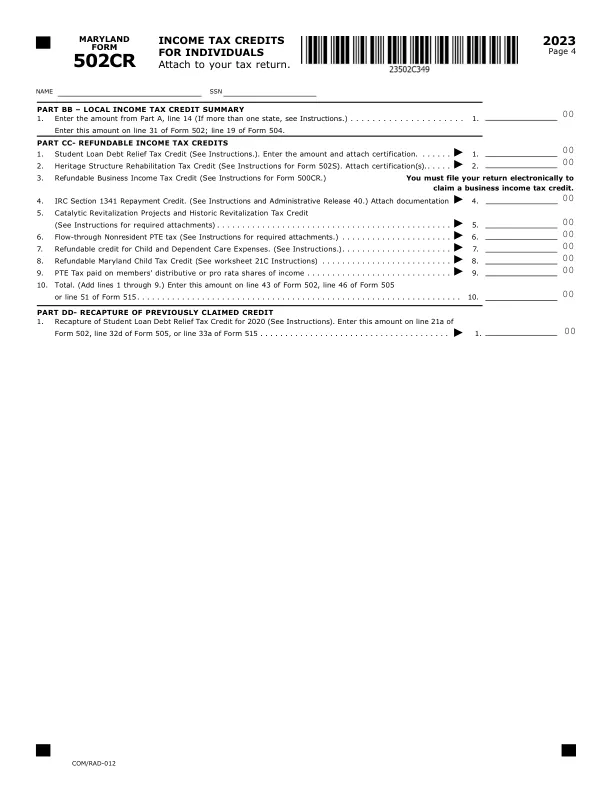

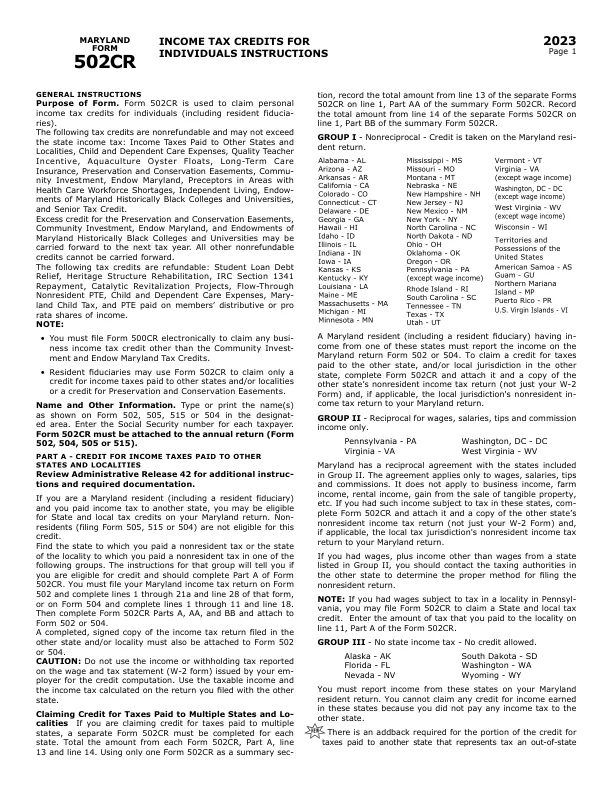

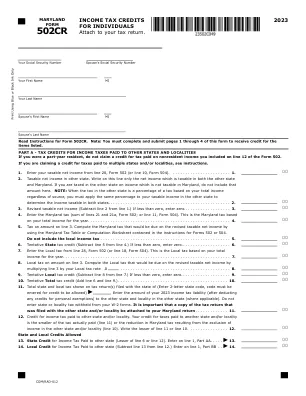

形式的一般说明目的。表格502CR用于要求个人(包括居民Fiducia Ries)要求个人所得税信用。The following tax credits are nonrefundable and may not exceed the state income tax: Income Taxes Paid to Other States and Localities, Child and Dependent Care Expenses, Quality Teacher Incentive, Aquaculture Oyster Floats, Long-Term Care Insurance, Preservation and Conservation Easements, Commu nity Investment, Endow Maryland, Preceptors in Areas with Health Care Workforce Shortages, Independent Living, Endow ments of Maryland Historically Black Colleges and Universities, and Senior Tax 信用。对保存和保护地役权,社区投资,马里兰州的捐赠和马里兰州的捐赠的过多信用可能会延续到下一个纳税年度。所有其他不可退还的信用均不能提出。可退还以下税收抵免:学生贷款债务减免,遗产结构康复,IRC第1341条还款,催化振兴项目,流通非居民PTE,儿童和依赖的护理费用,玛丽土地儿童税以及PTE支付的成员分配或收入的分配或收入股份。注意:

2023 502CR个人的所得税信用