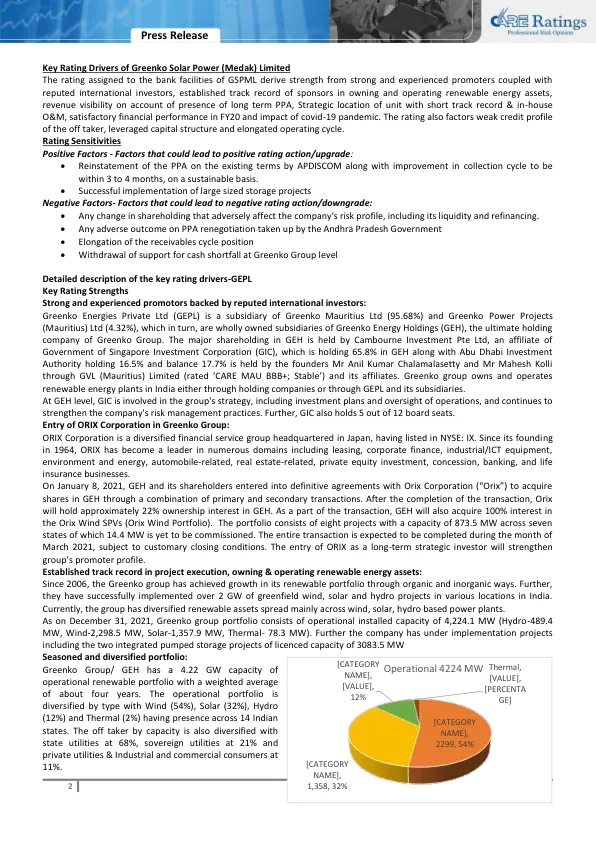

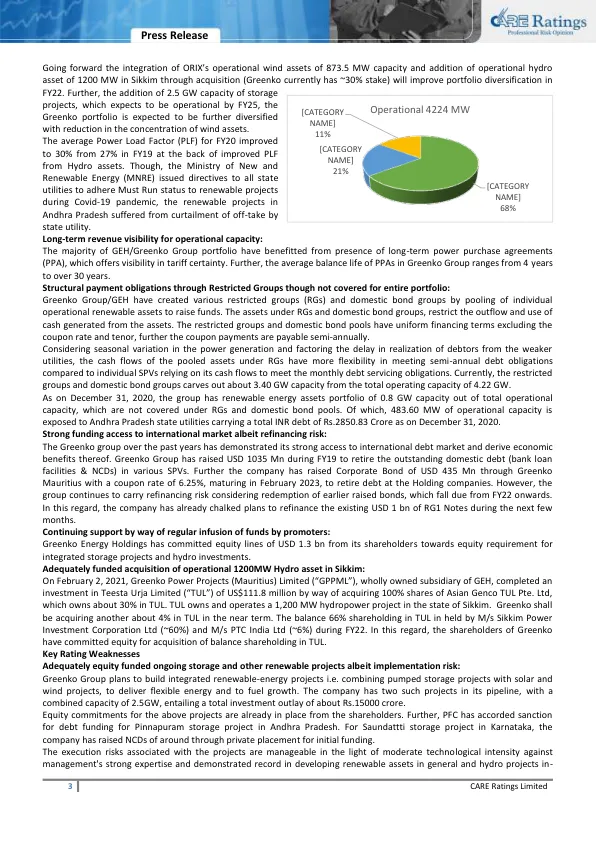

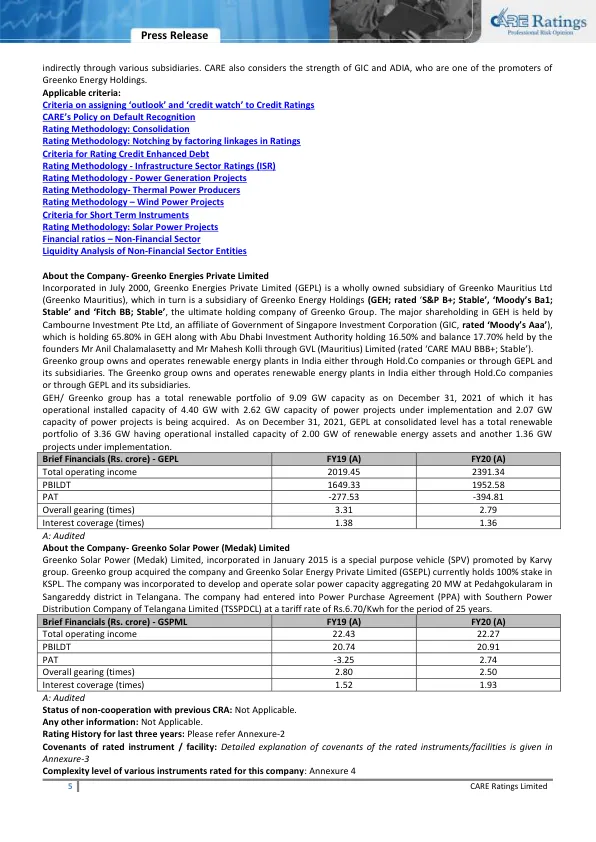

Unsupported Rating 2 CARE BBB+ Note: Unsupported Rating does not factor in the explicit credit enhancement Detailed Rationale & Key Rating Drivers for the credit enhanced debt The rating assigned to the long-term instruments of Greenko Solar Power (Medak) Limited is backed by unconditional and irrevocable corporate guarantee extended by Greenko Energies Private Limited [GEPL, rated CARE A+ (CWN) / CARE A1+(CWN)]。详细的基本原理和格林科能量的关键评级驱动力私人有限护理继续将格林科能量的评级置于“具有负面影响的信用观察”上。评级手表遵循由GoAP组成的高级谈判委员会(HLNC)的未决结果,用于审查风能和太阳能购买协议,并与向AP分销公司(Discoms)(Discoms)出售风能和太阳能的人进行谈判,以降低价格并提出适当的建议。评级手表主要是由于时间表的持续不确定性,以解决与Andhra Pradesh州立公用事业有关的与PPA关税有关的问题。护理将继续密切监视情况,并将根据解决过程的结果进一步评估开发项目对公司信用质量的影响。重新确认了分配给银行设施的评级和Greenko Energies Private Limited(GEPL)的长期工具在其最终控股公司级别的强度级别,其中大部分股份由Cambourne Investment Pte持有。Limited (an affiliate of Government of Singapore Investment Corporation), experience of the founders, established track record of the group in owning and operating diversified portfolio of renewable energy assets, experience in executing large scale renewable energy projects, availability of the long-term off-take arrangement for most of the operating projects providing long term revenue visibility, infusion of equity and unsecured loans by the promoters, strong ability of the group to access international and国内债务市场,通过限制群体和国内债券集团(占运营投资组合的约80%)的结构性支付义务以及可再生能源部门的稳定前景。评级还因20财年的总营业收入而增加(指4月1日至3月31日的期间),集团在受限制组,债券池和其他项目SPV中的流动性位置,在喜马al尔邦收购了100 MW Hydro Project,拟议中,从orix Corporiation中获得了873.5 MW的运营能力,并获得了873.5 mw的运营能力。 hydro asset of Teesta Urja Ltd by Greenko Power Projects (Mauritius) Ltd, a subsidiary of GEH and equity commitment by the shareholders of GEH towards the pumped storage projects and adequate liquidity position However, the ratings are constrained by implementation of integrated renewable energy projects involving huge capex, counterparty credit risk, refinancing risk, leveraged capital structure, stretched operating cycle led by high collection period and依赖气候条件。

咨询工程师集团有限公司 - 2024年12月23日

主要关键词