These Guidelines are issued by the Financial Services Commission (the “FSC”) as the supervisor of financial insTtuTons (FIs) and the Financial InvesTgaTon Agency (the “FIA”) as the AnT-Money Laundering, Counter-Financing of Terrorism and Counter-ProliferaTon Financing (AML/CFT/CPF) supervisor of Designated Non-Financial Businesses and Professions (DNFBPs) in the维尔京群岛(VI)。The FSC is responsible for the regulaTon and supervision of the financial services sector: (i) banking, (ii) insurance, (iii) trust and company services providers (“TSCPs”), (iv) investment business, (v) financing business (FB), (vi) money service businesses (“MSBs”), (vii) insolvency services, and (viii) virtual asset service提供者(“ VASP”)。The FIA is responsible for the supervision and monitoring of DNFBPs in the VI: (i) legal pracTToners, (ii) notaries public, (iii) accountants, (iv) real estate agents, (v) dealers in precious metals and stones (“DPMS”), (vi) high value goods dealers (“HVGD”), (vii) vehicle dealers, and (viii) persons engaged in the买卖船的业务。出于这些准则的目的,FSC和FIA所监督的元素被收集为“许可人”。作为主管,FSC和FIA意识到需要确保所有被许可人都知道与其业务相关的各种风险。作为有能力的授权理事会的联合监督委员会的成员,FSC和FIA与正在进行的Cooperaton和Ma'ers的合作委员会相关,这些MA`人会影响被许可人,以确保有适当的风险Mitgaton并提高透明度,同时保持VI的声明范围,以维持VI的声明,以开展合法和优质的业务。被许可人的综合AML/CFT/CPF合规性是至今仍具有不利影响操作量的不断发展的风险。这些准则是为在实施中的助理持有人的利益制定的,该方法是一种基于风险的方法,采用了一种基于风险的方法,用于对米特盖特进行措施,以防止洗钱(“ ML”),恐怖措施(“ TF”)和繁殖(“ PF”(“ PF”)风险,通过经常监测经济型和业务,可通过不断监测的经济制度和业务监测。Importantly, these Guidelines also bu`ress the provisions for compliance with the AnT-Money Laundering and Terrorist Financing Code of PracTce (the "AMLTFCOP"), the AnT-Money Laundering RegulaTons (the "AML RegulaTons"), the Regulatory Code (the "RC"), the Financial InvesTgaTon Agency Act (the “FIA Act”) and the Financial Services Commission Act (the "FSC Act"), including any这些文件的说明。这些准则还可以补充持续报告并与FSC,国际汽联和其他有能力的作者(包括执法机构)互动的需求,以实现OPTMAL结果,以防止ML,TF和PF风险实现。这些机构包括州长(GO),A'orney General's Chambers(AGC),皇家维尔京群岛警察部队(RVIPF)和BVI国际税务局(ITA)的办公室。

有效的监视方法

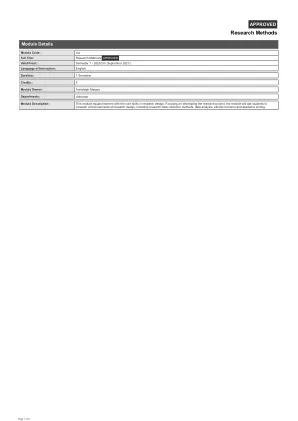

主要关键词